In 2023 almost all businesses are shifting to the cloud because of its amazing features. If you’re a small business owner or freelancer, you know how important it is to keep your finances in order. However, managing your finances and bookkeeping can be a time-consuming and complicated task. That’s where cloud-based accounting software comes in. In this blog post, we’ll explore the numerous benefits of using cloud-based accounting software to manage your finances and grow your business. From increased flexibility and security to automatic updates and more, you’ll see why so many businesses are making the switch to cloud-based solutions. Let’s dive in!

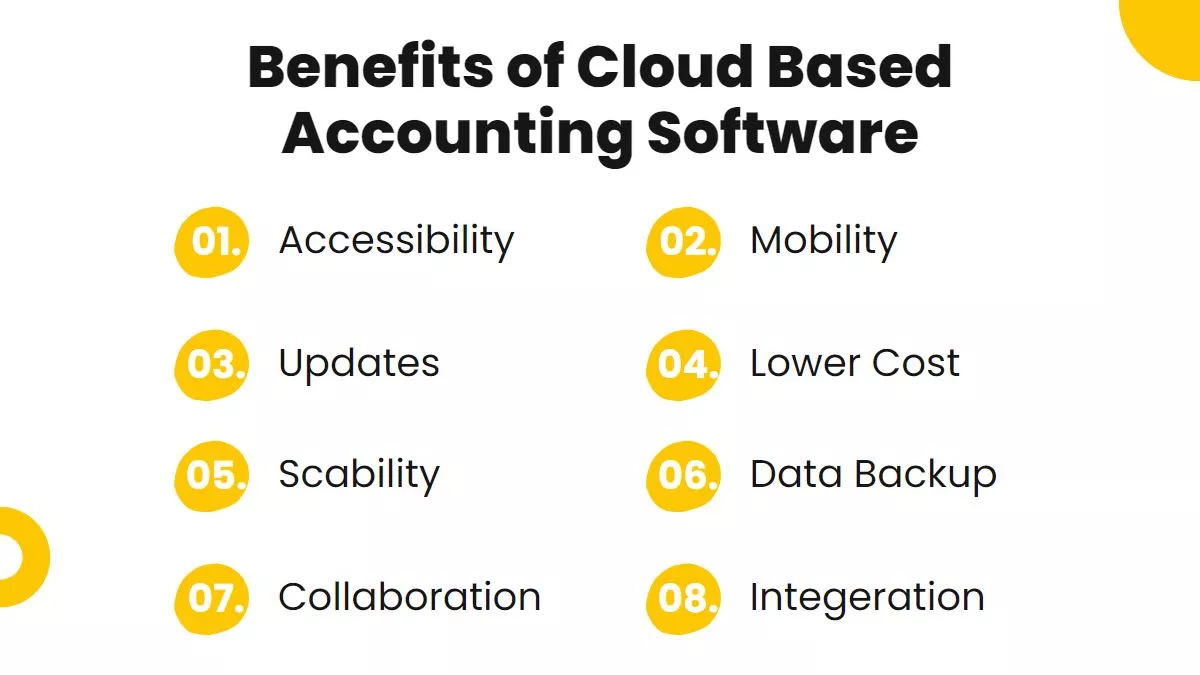

Benefits of using cloud-based accounting software

Every software comes with great advantages, so cloud-based accounting software also comes with a lot of benefits but the cloud is directly based on the internet and it is very important to utilize all safety and security measures while using these accounting applications. Here are 10 advantages of cloud-based accounting applications.

1. Accessibility

One of the main benefits of cloud-based accounting software is that it can be accessed from any device with an internet connection. This means that users can view and update their financial data and documents from anywhere, at any time. For example, a business owner who is traveling for work can access their financial information on their laptop or smartphone and make updates as needed. This can be especially useful for businesses with remote employees or those that need to access their financial information while on the go.

2. Mobility

Because it can be accessed from any device with an internet connection, cloud-based accounting software allows businesses to work from anywhere. This can be especially useful for businesses that have employees in different locations or that need to be able to access their financial information while out of the office. For example, an employee who is working from home can access the accounting software and update financial records just as easily as if they were in the office.

3. Automatic updates

Cloud-based software is automatically updated by the provider, which means that users always have access to the latest features and functions. This can be especially useful for businesses that want to take advantage of new features and functionality without the need to manually update the software themselves. For example, if the software provider releases a new feature that allows businesses to track expenses more easily, users will automatically have access to this feature without having to install any updates.

4. Lower upfront costs

Cloud-based software generally has lower upfront costs than on-premises software because there is no need to purchase and maintain hardware or infrastructure. This can be especially appealing for small businesses or startups that may have limited financial resources. Instead of having to purchase and install the software on their own servers, businesses can simply sign up for a subscription to the cloud-based software and start using it right away.

5. Scalability

Cloud-based software can be easily scaled up or down to meet the changing needs of a business. This means that businesses can add or remove users, or upgrade to a different plan as their needs change. This can be especially useful for businesses that are growing quickly and may need to scale their accounting software to meet their increased needs. For example, if a business hires additional employees and needs to add more users to the software, it can simply upgrade to a plan that allows for more users.

Read Similar: Importance of subsidiary Books

6. Data backup and recovery

Cloud-based software providers typically offer robust data backup and recovery systems to protect against data loss. This can give businesses peace of mind and protect against data loss due to hardware failures or other issues. For example, if a business’s server experiences a hardware failure and the data is lost, the data can be recovered from the cloud-based software provider’s backup systems.

7. Collaboration

Many cloud-based accounting software programs include collaboration tools that allow multiple users to work on the same documents and data in real time. This can be especially useful for businesses that have multiple employees working on the same financial tasks or that need to be able to review and approve financial documents quickly. For example, if a business needs to review and approve a vendor invoice, multiple users can view and make changes to the invoice at the same time.

8. Integration

Many cloud-based accounting software programs can be easily integrated with other software and systems, such as CRM and invoicing systems. This can help businesses streamline their operations and improve efficiency by having all of their business-critical systems in one place. For example, if a business uses a CRM system to track customer interactions and a cloud-based accounting software to track financial information, integration between the two systems can allow the business to see all of its customer interactions and financial data in a single place. This can be especially useful for businesses that need to track customer interactions in relation to specific financial transactions.

9. Security

Reputable cloud-based software providers generally have robust security measures in place to protect against data breaches and cyber-attacks. This can give businesses peace of mind that their sensitive financial data is being kept secure. These measures may include encryption, secure servers, and multiple layers of security to protect against unauthorized access.

10. Technical support

Most cloud-based software providers offer technical support to help users with any issues or questions they may have. This can be especially useful for businesses that are new to using accounting software or that have limited technical expertise. Technical support can help businesses troubleshoot any issues they may have with the software and get the most out of the software.

Read Similar: Statement of Expenditure

11. Customization

Many cloud-based accounting software programs allow users to customize their dashboards, reports, and other features to meet the specific needs of their businesses. This can be especially useful for businesses that have unique financial reporting needs or that need to track specific data points. For example, a business may want to create a custom report that tracks the profitability of different products or services. Customization can help businesses get the most out of their accounting software and ensure that it meets their specific needs.

12. Time-saving features

Many cloud-based accounting software programs include time-saving features such as automatic bank reconciliation and invoicing. Automatic bank reconciliation allows businesses to easily match their bank statements to their accounting records, which can help save time and reduce the risk of errors. Invoicing features can help businesses create and send invoices quickly and easily, which can improve cash flow and reduce the time spent on invoicing tasks.

13. Secure data storage

Cloud-based software providers generally offer secure data storage to protect against data loss due to hardware failures or other issues. This can give businesses peace of mind that their financial data is being kept safe and secure. Many providers use encryption, secure servers, and multiple layers of security to protect against unauthorized access to data.

Read Further: External Recruitment and it’s methods

14. Easy to use

Many cloud-based accounting software programs are designed to be easy to use, even for those who are not familiar with accounting principles. This can be especially useful for small business owners who may not have a background in accounting or finance. Cloud-based software often includes user-friendly interfaces and step-by-step guides to help users navigate the software and perform tasks such as creating invoices or generating reports.

15. Data analysis and reporting

Cloud-based accounting software can provide businesses with real-time data analysis and reporting tools that can help them make better-informed business decisions. These tools can provide insights into a business’s financial performance, customer behavior, and other key metrics. For example, a business may be able to use the software to track sales trends over time or to identify areas where they are overspending. Data analysis and reporting tools can help businesses identify areas for improvement and make more informed business decisions.

Read Similar: Diminishing Balance Method

16. Improved data accuracy

Cloud-based software can help improve data accuracy by automating tasks such as bank reconciliation and eliminating the need for manual data entry. This can help reduce the risk of errors and improve the accuracy of financial reports.

17. Improved financial visibility

Cloud-based accounting software can provide businesses with real-time financial visibility, allowing them to see their financial data and make informed business decisions in real time. This can be especially useful for businesses that need to make quick financial decisions or that need to track financial data in real time.

In conclusion, the use of cloud-based accounting applications offers numerous benefits for businesses of all sizes. The ability to access financial data from anywhere with an internet connection increased security of financial data, and automatic updates are just a few of the advantages that make cloud-based solutions a smart choice for managing finances. Whether you’re a small business owner, freelancer, or part of a larger organization, the convenience, efficiency, and security offered by cloud-based accounting applications make them an essential tool for modern businesses.