If you’re not familiar with the term, a Fund Flow Statement is a financial report that shows the inflows and outflows of funds within a company. The Fund Flow Statement is a crucial tool for companies to assess their financial health, make informed investment decisions, and plan for the future. In this post, we’ll dive into the definition, objective, importance, advantages, disadvantages, and format of the Fund Flow Statement. By taking advice from some of the known people in accountancy and economics here we are providing a detailed guide on fund flow statements. So, let’s get started and explore the world of the Fund Flow Statement together!

Definition of Fund Flow Statement

A Fund Flow Statement is a financial report that shows the inflows and outflows of funds within a company over a specific period of time, typically a quarter or a fiscal year. It provides a detailed analysis of a company’s sources and uses of funds, including cash, investments, and other financial assets.

The statement helps businesses identify how much money is coming in and going out, and where it is being allocated. This information can be used to assess a company’s financial health, make informed investment decisions, and plan for the future.

Learn about: External Recruitment

What is the format for fund flow statement?

The he Fund Flow Statement format consists of two parts: the sources of funds and the uses of funds.

The sources of funds section shows the inflows of funds into the company during a specific period, such as a quarter or a fiscal year. This section typically includes items such as the sale of assets, issuance of stocks or bonds, and proceeds from loans.

The uses of funds section shows the outflows of funds from the company during the same period. This section typically includes items such as investments in fixed assets, repayment of loans, and dividend payments to shareholders.

The sources of funds and uses of funds sections are then reconciled to show how the net change in funds occurred during the period. This reconciliation provides insights into how the company is using its funds and helps management make better-informed decisions about future investments and cash management.

Here I am going to show you format of fund flow statement for any company

Fund Flow Statement for a hypothetical company for the fiscal year 2022:

Sources of Funds

- Proceeds from the issuance of common stock – $100,000

- Proceeds from the issuance of long-term debt – $200,000

- Proceeds from the sale of fixed assets – $50,000

- Cash inflow from operations – $400,000

- Total sources of funds – $750,000

Uses of Funds

- Purchase of new equipment – $150,000

- Repayment of short-term debt – $75,000

- Payment of dividends to shareholders – $50,000

- Purchase of a new office building – $400,000

- Total uses of funds – $675,000

Net Change in Funds

Total sources of funds – Total uses of funds = $750,000 – $675,000 = $75,000

In this simplified Fund Flow Statement, we can see that the company had a net inflow of funds of $75,000 for the fiscal year 2022. The sources of funds included proceeds from the issuance of common stock, long-term debt, and the sale of fixed assets, as well as cash inflows from operations. The uses of funds included the purchase of new equipment, repayment of short-term debt, and payment of dividends to shareholders, as well as the purchase of a new office building.

Example of Fund Flow Statement

Here is given transactions of the company:

| Transaction | Amount (in USD) |

|---|---|

| Net profit for the year | 100,000 |

| Depreciation | 20,000 |

| Issue of shares | 50,000 |

| Sale of equipment | 30,000 |

| Purchase of new equipment | 60,000 |

| Dividend paid | 10,000 |

| Repayment of long-term loan | 40,000 |

| Increase in accounts payable | 5,000 |

| Decrease in accounts receivable | 8,000 |

| Increase in inventory | 12,000 |

| Sale of investment | 25,000 |

| Purchase of investment | 15,000 |

To prepare the fund flow statement, we need to classify each transaction as a source or use of funds. Sources of funds represent increases in the company’s net working capital, such as profits, issuing shares, or selling assets. Uses of funds represent decreases in the company’s net working capital, such as paying dividends, buying assets, or repaying loans.

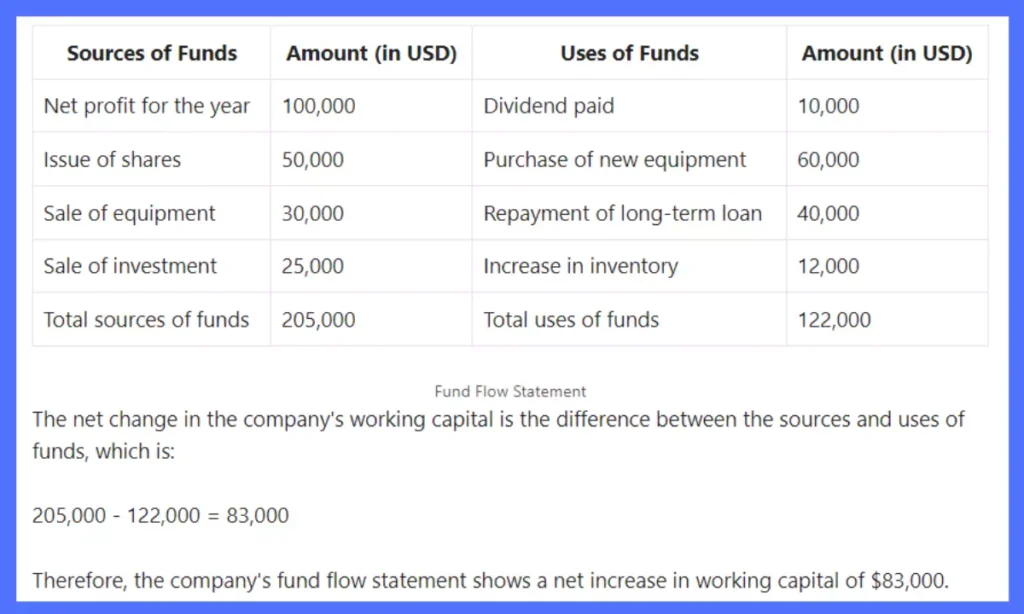

Here’s a table summarizing the sources and uses of funds:

| Sources of Funds | Amount (in USD) | Uses of Funds | Amount (in USD) |

|---|---|---|---|

| Net profit for the year | 100,000 | Dividend paid | 10,000 |

| Issue of shares | 50,000 | Purchase of new equipment | 60,000 |

| Sale of equipment | 30,000 | Repayment of long-term loan | 40,000 |

| Sale of investment | 25,000 | Increase in inventory | 12,000 |

| Total sources of funds | 205,000 | Total uses of funds | 122,000 |

The net change in the company’s working capital is the difference between the sources and uses of funds, which is:

205,000 – 122,000 = 83,000

Therefore, the company’s fund flow statement shows a net increase in working capital of $83,000.

You Must Understand : How To Improve Business Ethics

How to create Fund Flow Statement In Excel

If you want to prepare your fund flow statement in excel then I can also guide you step wise. You don’t need to be pro to prepare this statement but you should know the basics of using excel.

Steep by Step guide to prepare Fund Flow Statement in Excel

Step 1: Prepare your data

Gather all the financial data you need for your Fund Flow Statement. This will typically include information on cash inflows, cash outflows, and changes in capital.

Step 2: Open a new Excel spreadsheet

Open a new Excel spreadsheet and create a table to input your data. You may want to organize your data into columns and rows to make it easier to work with.

Step 3: Create the opening and closing balance columns

Create two columns for opening and closing balances. These will be used to calculate the net increase or decrease in your funds.

Step 4: Enter your cash inflows and outflows

Enter your cash inflows and outflows in separate columns. You may want to label these columns to make it clear which values represent inflows and which represent outflows.

Step 5: Calculate the change in cash

Subtract your cash outflows from your inflows to determine the change in cash for each period. Enter these values in a separate column.

Step 6: Calculate the net increase or decrease in funds

Add the change in cash to your opening balance to determine your closing balance. Repeat this for each period. This will allow you to determine the net increase or decrease in funds for each period.

Step 7: Create the Fund Flow Statement

Create a table to display your Fund Flow Statement. Include columns for inflows, outflows, and net increase or decrease in funds. Use your data from earlier steps to fill in these values.

Step 8: Review and analyze your statement

Once you’ve created your Fund Flow Statement, review it carefully. Look for any trends or patterns that may be of interest. Use your statement to identify areas where you can improve your financial performance.

That’s it! By following these steps, you can easily create a Fund Flow Statement in Excel.

Importance / Advantages of Fund Flow Statement

1. Helps in understanding the changes in the financial position of a business

The Fund Flow statement provides information on the sources and uses of funds in a business, making it easier to understand how the business is managing its finances and where the funds are being utilized.

2. Helps in decision-making

By analyzing the Fund Flow, managers can make informed decisions about capital investments, budget allocation, and other financial decisions.

3. Helps in identifying cash flow issues

The Fund Flow statement can help in identifying cash flow issues in a business, such as a negative cash balance, and can help in developing strategies to address these issues.

4. Helps in evaluating the financial performance

The Fund Flow provides a clear picture of the financial performance of a business, enabling stakeholders to evaluate the business’s financial health and make informed decisions.

5. Helps in complying with regulatory requirements

In many countries, businesses are required to prepare Fund Flow statements as part of their financial reporting requirements. By preparing a Fund Flow statement, a business can comply with these regulatory requirements and avoid penalties.

Disadvantages of Fund Flow Statement

1. Limited information

The Fund Flow statement provides information only on the sources and uses of funds, which can be limited in scope. It does not provide details about the specific transactions or activities that led to changes in the financial position of the business.

2. Complex preparation process

Preparing a Fund Flow statement can be a complex and time-consuming process, especially for businesses with large and complex financial transactions.

3. Difficulty in interpretation

The Fund Flow statement can be difficult to interpret for non-financial experts, as it involves a lot of financial jargon and technical terms.

4. Historical in nature

The Fund Flow statement provides information on past financial transactions and does not provide information on future financial performance or the current financial position of the business.

5. Potential for manipulation

The Fund Flow statement can be manipulated by businesses to present a more favorable financial position, especially if the statement is prepared by the business itself without external oversight.

6. Limited usefulness for investors

Investors may find the Fund Flow statement less useful than other financial statements, such as the Income Statement and Balance Sheet, as it provides limited information on the profitability and financial health of the business.

Do you know about : Statement Of Expenditure

Objectives Of Fund Flow Statement

The fund flow statement, also known as a statement of changes in financial position, is a financial statement that reports on the inflows and outflows of funds in an organization over a specified period. The main objectives of a fund flow statement are:

- To provide information on the sources and uses of funds: The fund flow statement helps users to identify the sources from which funds were generated and how those funds were utilized during the period under consideration. This information is critical in understanding the financial position of an organization.

- To analyze changes in the financial structure: The fund flow statement provides a snapshot of the financial structure of an organization. It helps users to analyze how changes in the financial structure of the organization have occurred over time.

- To assist in forecasting future financial requirements: By analyzing the pattern of inflows and outflows of funds over time, the fund flow statement can help in forecasting future financial requirements. This information can assist in making investment and financing decisions.

- To provide information on the liquidity position of an organization: The fund flow statement provides information on the liquidity position of an organization. It helps in assessing the ability of the organization to meet its short-term obligations.

- To evaluate the efficiency of management: The fund flow statement provides information on the management’s ability to generate and utilize funds efficiently. It is an important tool for evaluating the performance of management.

FAQs

What is a Fund Flow Statement?

A Fund Flow Statement is a financial statement that shows the inflow and outflow of funds during a specific period, generally one year. It displays the sources and uses of funds and helps to identify changes in the financial position of a company.

What are the sources of funds in a Fund Flow Statement?

The sources of funds in a Fund Flow Statement are various, including cash sales, issue of shares, loans from financial institutions, sale of assets, and increase in the working capital.

What are the uses of funds in a Fund Flow Statement?

The uses of funds in a Fund Flow Statement include repayment of loans, payment of dividends, purchase of assets, payment of taxes, and decrease in the working capital.

What is the difference between a Fund Flow Statement and a Cash Flow Statement?

While both statements analyze a company’s financial position, the Fund Flow Statement focuses on long-term financial changes, such as changes in the company’s capital structure. On the other hand, the Cash Flow Statement provides information about the company’s liquidity and cash inflows and outflows during a specific period.

What are the benefits of a Fund Flow Statement?

The Fund Flow Statement is beneficial as it helps to identify changes in the financial position of a company, helps to monitor the effective utilization of funds, assists in decision-making, helps to analyze the liquidity and solvency position of a company, and helps to identify areas of improvement in financial management.

How is the Fund Flow Statement prepared?

The Fund Flow Statement is prepared by analyzing the balance sheets of two or more years. The changes in the balance sheets help to identify the sources and uses of funds during a specific period. The statement shows the beginning and ending balance of cash and other sources and uses of funds.

Who uses the Fund Flow Statement?

The Fund Flow Statement is useful for investors, creditors, and management in assessing the financial position and performance of a company. It is also used by financial analysts and investment advisors to evaluate the effectiveness of financial management.